Related Posts

Employers and Organizations

Boom! Goes Retirement

Last Update: March 20, 2017

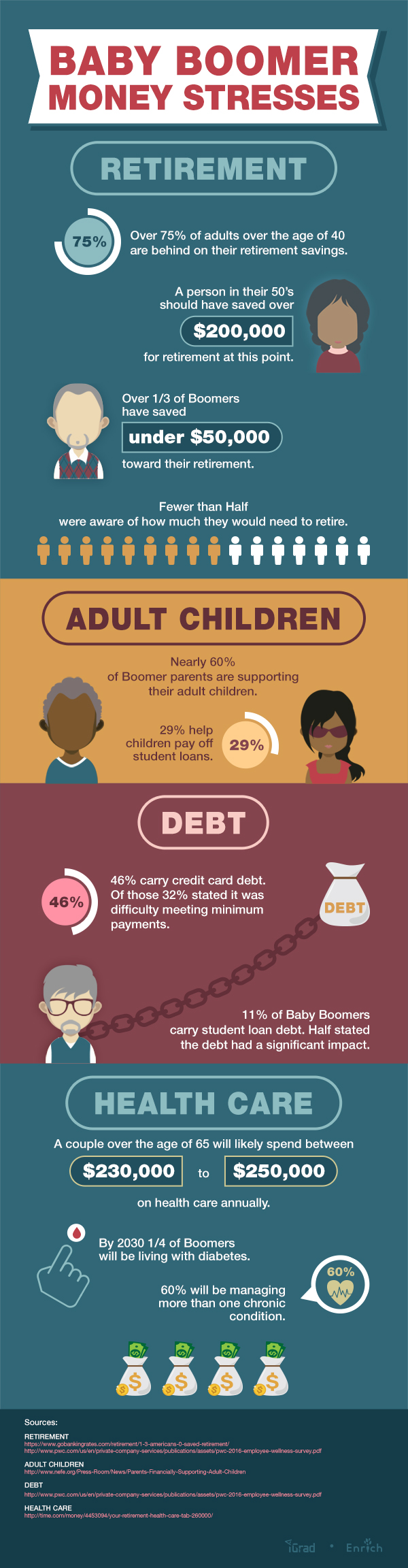

Almost half of the population of America’s workforce is composed of the old guard, the Baby Boomers. The median income of a workplace colleague of the Baby Boomer generation is around $70,000. They face fluctuating health care costs and reforms, volatile interest rates, mountainous debt (either from themselves or their children) and a constantly evasive retirement endgame.

On the precipice of a major life/work-milestone like retirement, finances need to be looked at and put in order, and yet, according to Bankers Life Center for a Secure Retirement, over 80% of Baby Boomers have not received any specialized training or education related to retirement financial solvency. Along the same lines, nearly 60% do not receive any professional financial guidance whatsoever.

In order to bring the most benefit to your Boomer associates, it’s important to be aware of each of the “pain points” facing your Baby Boomer colleagues at the moment and how to best combat those issues.

Review, Reduce, Refresh

The simple and unfiltered answer to the pressing demand is: Baby Boomers need to save more money NOW. But how?

Financial Planning

A financial wellness platform like Enrich is one of the most immediate ways to aid your Baby Boomers on their way to retirement, thereby keeping your workforce rotating and fresh. By providing access to comprehensive information and guidance the Boomer’s are empowered to take control of otherwise runaway finances and swell their retirement accounts.

The benefit of a financial wellness platform usually comes down to the question of engagement. By being able to identify the unique money stresses colleagues face will enable engagement in the platform. A financial wellness platform will help identify and react to significant money drains and other creative ways to cut expenses such as:

Money Drains

One immediate change to make is to reduce wasteful spending. Hloom provides details on wasteful spending by generation. By far and away “eating out” is among the most prevalent waste of money among Baby Boomers by over 25 percent! “Cable or Digital TV” was the second runner-up with “uneaten or expired food” hot on its heels. Credit card interest and grocery items made up the top five categories.

By simply reducing or eliminating these particularly wasteful expenditures, Baby Boomers may lose the indulgent lifestyle they’ve become accustomed to, but they’ll add to their lifestyle in the retirement years to come.

Refresh

It’s a good time, on the cliff-face of retirement, to look at lifestyle adjustments.

- If kids are out of the house now might be an ideal time to investigate moving into smaller, cheaper housing and leave the mortgage behind.

- When was the last time you checked your credit score or credit card APR? If nothing else, try getting on the phone and negotiating lower rates. Looking into things that have been on auto-pilot can refresh your finances.

- Are you over-insured? Take a look at your insurance situation. It’s possible you are covering things that no longer need covering.

- Discounts! Take advantage. Every cent matters when you are facing a precarious retirement. As a senior, or approaching “seniorhood”, you are entitled to a slew of discounts. Check out this list from The Senior List for suggestions.

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

3 MIN

How Financial Wellness Programs Help Employees Retire On Time

Employers and Organizations

4 MIN

How Student Loan Debt is Affecting Baby Boomer Employees

Employers and Organizations

5 MIN

Your Younger Employees Want to Retire Earlier – 10 Ways to Help Them Meet Their Goal