Related Posts

Employers and Organizations

Financial Wellness Should Play a Major Role in Your Post-Pandemic Employee Benefits Strategy

Last Update: April 18, 2022

Benefits managers have a tough job right now. They have to make sure benefits programs meet employee needs, but these benefits must also support the organization's goals.

The intersection of these two directives is financial wellness.

Employee financial stress was already high before the pandemic, and now it is even higher. The 2021 PwC Employee Financial Wellness Survey1 found that the pandemic wreaked havoc with employee finances.

Since the pandemic, a quarter of employees experienced decreased household income, and four out of ten have trouble meeting their monthly expenses.

Additionally, they have more credit card debt, more financial insecurity, are more likely to file for bankruptcy, have depleted their emergency savings, and are more likely to borrow from their retirement funds to make ends meet.

Another study2 found that merely thinking about personal finances causes significant stress for six out of ten employees. Plus, 65% of those surveyed stated that household debt was a problem.

In addition to monthly bills, household debt, and meeting emergency expenses, employees are also concerned with:

- Student loan debt

- Saving money

- Retirement investments

- Cost of medical insurance and medical care

- Rising home prices

- Inflation

Unfortunately, employees bring this stress to work with disastrous results for their employees.

The Cost of High Financial Stress

When employees have financial stress, their employers suffer financial losses. For example, stressed employees are less productive.

Studies3 show that businesses lose 47 hours per worker, per year, due to presenteeism and absenteeism. Absenteeism alone costs companies $2,660 per employee per year4.

However, according to a study by GCC, the cost of presenteeism is ten times that of absenteeism5.

Other costs associated with employee financial stress include:

- Lack of retirement readiness: Pushes workforce cost up 1% to 1.5%6

- Turnover: Turnover costs an average of $15,000 per employee7

- Healthcare expenses: Workers with high stress have double the healthcare expenditures of non-stressed employees8

- On-the-job accidents: Stress-related accidents cost twice as much as non-stressed related accidents9

These statistics show that benefits that alleviate financial stress should be a top priority for benefits managers.

Employees Want More Than Retirement Information

Traditionally, financial wellness benefits center around retirement savings advice specifically related to the company's 401(k) plans.

There is nothing wrong with offering this type of education because employees agree it is necessary. However, employees also need a lot more.

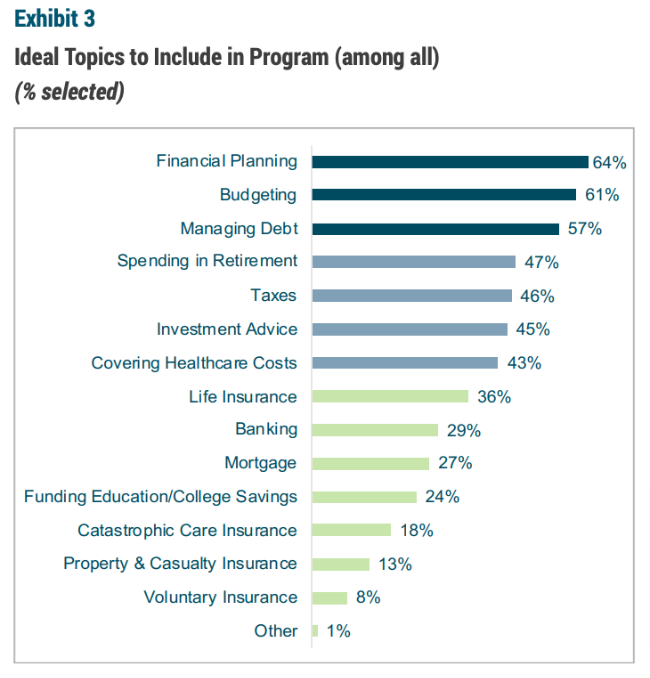

The DCIAA Retirement Research Center10 found that employees want financial wellness that touches on a variety of topics – from budgeting to taxes and even insurance.

Image Source: DCIAA Retirement Research Center10

This list shows that employee financial stress includes – but is not limited to – retirement savings. Benefits managers need to find financial wellness solutions that meet the needs of their employees.

Thankfully, this shift is on the rise. Based on an Alight report11, companies now offer more financial wellness solutions to employees.

Here are some statistics comparing the 2022 survey to the 2018 survey:

- Basic education about financial markets and investing: 71% up from 46%

- Budgeting education: 59% up from 35%

- Health education and planning: 52% up from 34%

However, employers can still do more to improve employee financial wellness and reduce financial stress.

Providing the Right Financial Wellness Benefits

When creating a financial wellness benefits package, benefits managers should focus on three core areas to provide optimal results.

- Determine employee needs: Your specific workforce is unique, so using a one-size-fits-all approach will not be as beneficial as determining what employees want and will utilize. Benefits managers can use utilization data from current benefits, absenteeism data, and retirement plan data. They can also conduct employee surveys to determine what matters most to employees.

- Find programs that meet those needs: A benefits manager should see if there are currently benefits that meet needs but are underutilized. Then, they should find other sources to fill in any gaps.

- Engage employees: Employee engagement must center around communications that promote the offered benefits. These communications should help employees see how these benefits provide solutions to their current problems. Best practices for benefits communications include clarity, regularity, and relevancy. In the beginning, benefits managers should focus on awareness and enrollment.

Enrich offers holistic workplace financial wellness programs to employers, organizations, financial institutions, credit unions, and Financial Advisers. To learn how the Enrich program can help you provide financial wellness benefits to your employees, schedule a demo today.

1 - https://www.pwc.com/us/en/services/consulting/workforce-of-the-future/library/employee-financial-wellness-survey.html

2 - https://www.ebri.org/docs/default-source/fast-facts/ff-411-wwsfw-11nov21.pdf?sfvrsn=f1be3b2f_4

3 - https://hbr.org/2004/10/presenteeism-at-work-but-out-of-it

4- https://www.circadian.com/blog/item/43-shift-work-absenteeism-the-bottom-line-killer.html

5 - https://gccmarketing.blob.core.windows.net/marketing-site/marketo/resources/presenteeism/us-presenteeism-whitepaper.pdf

6 - https://www.prudential.com/corporate-insights/employers-should-care-cost-delayed-retirements

7 - https://info.workinstitute.com/hubfs/2020%20Retention%20Report/Work%20Institutes%202020%20Retention%20Report.pdf

8 - https://www.cdc.gov/niosh/docs/99-101/default.html

9 - https://www.uml.edu/research/cph-new/worker/stress-at-work/financial-costs.aspx

10 - https://cdn.ymaws.com/dciia.org/resource/resmgr/resource_library/DCIIA-RRC-DesignofFinancialW.pdf

11 - https://www.alight.com/research-insights/hot-topics-in-retirement-2022

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

4 MIN

COVID Infected Financial Wellness But 3 Simple Steps Will Help

Employers and Organizations

3 MIN

Is Financial Wellness a Must-Have Employee Benefit?

Employers and Organizations

2 MIN

How to Increase Workplace Loyalty with This Financial Wellness Strategy