Related Posts

Employers and Organizations

New Study Shows that Employees Need a Financial Wellness Benefit

Last Update: August 16, 2021

The National Financial Educators Council (NFEC)1, an organization that sets industry standards for financial educators and counselors, shared the results of their most recent financial literacy testing data.

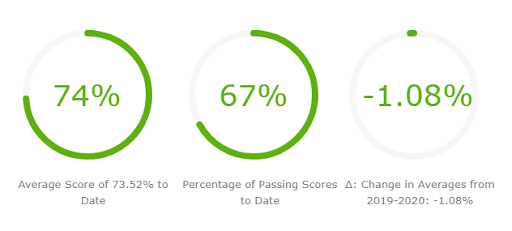

With participants in all age groups across all 50 U.S. states, 41 percent failed the test.

The results also show that the average test score of 67.93 percent is slightly lower than it was in 2018.

The Importance of Financial Literacy

Financial literacy is the first building block of financial wellness, which can only be achieved when employees have adequate financial knowledge and understand how to adjust their financial behaviors and decisions on that knowledge.

However, the numbers show that two out of five of your employees do not have this building block or do not know how to use the knowledge they have.

Related article: Financial Wellness Becomes One of the Most Desired Benefit Programs for 2021

National Financial Literacy Test

The test measures knowledge in 10 financial topic areas that include: Financial psychology, credit and debt, accounts and budgeting, skill growth, income, business relations, long-term planning, risk management, investments, and social enterprise.

Within these topics, the test also looks at three components of financial wellness:

- Motivation to learn: Understanding of how financial subjects impact their lives and how financial management relates to goals and dreams. A sample question for this component is: How can understanding risk management topics help me in everyday life?

- Subject knowledge: Measures what is known about a given financial topic. A sample question is: From the following list, choose the two best suggestions for building and maintaining a good credit rating.

- Ability to recognize first steps: Ability to take action based on the knowledge acquired. A sample question is: How do I begin the process of creating a long-term financial plan?

It is when an employee knows the ten topic areas combined with motivation and the ability to do something with the knowledge that employees can achieve financial wellness.

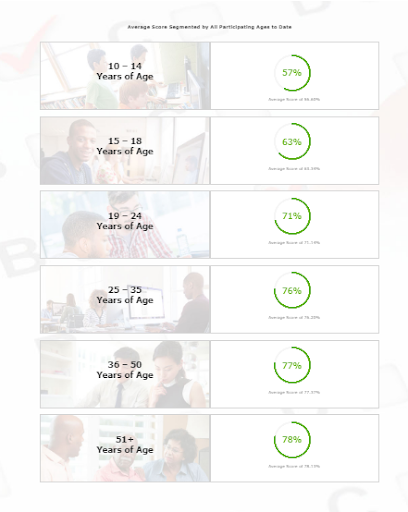

Although the average test scores get better based on the age of the participant. The results are still not stellar.

Even employees nearing retirement still missed a quarter of these basic financial questions, earning a 78 percent on the test, which is not significantly above a failing grade.

For a deeper dive into financial wellness, check out What is Financial Wellness?

Additional Test Results

In addition to sharing the results of the financial literacy test, NFEC also shared the results of three additional tests that corroborate the need for employee financial wellness benefits.

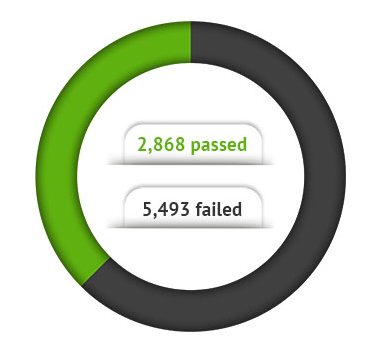

The Financial Foundation Test2 shows the capability of making entry-level financial decisions. These include questions about purchasing a car, renting a property, taking out loans, and paying off debt.

Even on such basic questions, a third of respondents failed this quiz.

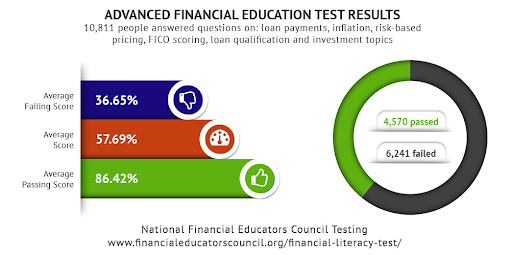

The Advanced Financial Education Test3 looks at money management, asking higher-level questions about financial matters.

This test tackles questions on subjects like inflation, credit scores, and investments. As the tests increase in difficulty, so does the percentage of failed test scores.

Finally, the Student Loan Test4 is designed for those going to or in college to help determine how ready they are to make student loan decisions.

Although your employees are beyond this age group, with the student loan crisis at $1.71 trillion5, many of your employees are likely dealing with the fallout of poor decisions- due to a lack of financial knowledge.

How Financial Wellness Benefits Can Help

Although the test data shows a large financial wellness deficit, there is something employers can do about it.

By providing a holistic financial wellness program, your employees will have access to courses, articles, tools, and tips concerning:

- Financial knowledge on a range of topics from budgeting to debt reduction to retirement savings.

- Why financial topics matter from the power of compounded interest to the issues from dealing with identity theft.

- The next steps to take depend on whether the employee is beginning to save for their first emergency fund or wants to shift their investment strategy to reduce risk as they near retirement.

Based on internal data from the Enrich platform, we know that the program drives behavior change.

Employees who use the program increased their financial wellness and reduced their financial stress through such activities as saving for goals and emergencies, contributing to the employer-sponsored 401(k), and paying off their credit card balance each month.

Additionally, employers win since less financial stress leads to less absenteeism, presenteeism, and distractions.

Keep Reading: Calculating the ROI for Employee Financial Wellness

1 - https://www.financialeducatorscouncil.org/national-financial-literacy-test/

2 - https://www.financialeducatorscouncil.org/financial-foundation-test-results/

3 - https://www.financialeducatorscouncil.org/advanced-financial-education-test-results/

4 - https://educationdata.org/student-loan-debt-statistics

5 - https://www.financialeducatorscouncil.org/student-loans-financial-education-test-results/

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Financial Institutions

3 MIN

15 States With the Best Financial Wellness

Employers and Organizations

4 MIN

How Comprehensive Financial Wellness Programs Prepare Employees For Uncertain Times

Enrich News

2 MIN

Empower Employees to Prepare for Retirement with New Course