Related Posts

Employers and Organizations

7 Ways to Help Close the Retirement Gender Gap

Last Update: September 19, 2022

When it comes to retirement preparedness, women are behind. Women’s 401(k) balances are 30% less than men's, and they contribute 22% less to their retirement funds1. This leads to almost half of unmarried female retirees relying on Social Security Benefits for the majority of their income2.

It isn’t that women are not concerned about retirement. Nearly half of women are not confident about their retirement savings and only 19% believe they will make it through retirement without running out of money3.

The issue is that women have a unique set of circumstances that interferes with their ability to save and makes their savings less effective.

Women report lower starting salaries than men. Additionally, they often take breaks from work to care for a child or other family member, which widens the salary gap and lessens the time available to save.

Due to lower salaries, women are more likely to take emergency loans from their 401(k) and less likely to use the catch-up features when they fall behind.

To make matters even worse, women actually need more money than men to retire. Women live, on average, five years longer than men4. This means they have to stretch their retirement savings over a greater length of time. This longevity also increases healthcare costs, exacerbating the financial issues for women.

Although offering a workplace retirement plan is a great start, there are several other things benefits managers can do to help close the retirement gender gap.

1. Understand Women’s Needs

The first thing is to consider women’s needs when putting together a benefits package. For example, the pay gap has many consequences for women that can be addressed.

Women earn 83 cents on the dollar compared to men, or $10,435 each year. By the end of her career, a full-time female employee will have lost over $400,000 in income5. Because of this disparity:

- Women may have difficulty paying down debt, saving for emergencies, and saving for retirement

- Communications about retirement savings focusing on a percentage of salary mean that women will automatically save less

- Lower wages mean lower Social Security benefits at retirement

Considering women’s needs when designing a benefits package is key to helping women retire with enough money to live comfortably.

2. Educate Women About Finances

Offering a financial wellness program can provide the information women need to make appropriate financial decisions throughout their careers. A holistic program can help them:

- Create a budget

- Reduce debt

- Increase savings

- Understand retirement costs including healthcare

- See the effects of early saving due to compound interest

- Learn about investing

- Understand the role of Social Security benefits

Such a program provides women with tips, tools, and next steps to help them become financially healthy now and in the future.

3. Offer a Health Savings Account (HSA)

For employers that offer a high-deductible health insurance plan, the addition of a Health Savings Account can help women save for healthcare costs now and in retirement. With an HSA, women can:

- Contribute pre-tax dollars

- Receive tax-deferred growth when investing the money

- Never pay taxes on the money if used for qualified healthcare expenses

The HSA is a great way for women to fund their retirement healthcare needs.

4. Consider Student Loan Repayment

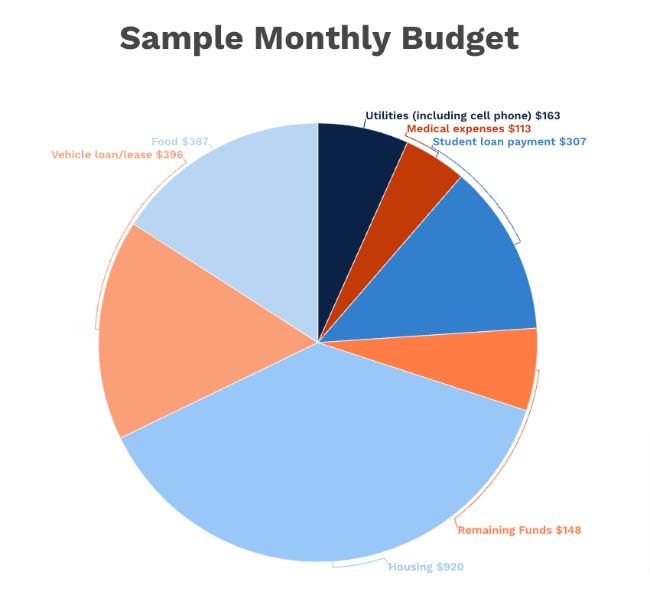

Student loan debt is over $1.6 trillion, and more women than men (40% to 28%) have student loan debt. The average loan payment for a woman is $307.

Upon graduation, with an average starting salary of $35,338, women are left with only $158 per month to handle childcare, clothing, personal care items, gas, and emergency savings6 – a nearly impossible task.

Image Source: AAUW’s 2021 Deeper in Debt report

Helping employees pay off student debt will increase a woman’s ability to save for retirement.

5. Provide an Employee-Sponsored Emergency Fund

Two out of five women do not have money in an emergency savings account7. Without an emergency fund, these women are far more likely to take a 401(k) loan when disaster strikes – reducing their retirement savings. Offering an employee-sponsored emergency fund can help.

There are many ways to offer an employee-sponsored emergency fund including:

- Split deposit

- Sidecar accounts attached to existing 401(k) plans

- Company matches

6. Access to a Financial Advisor

According to the 2020 Retirement Income Literacy Survey, nine out of ten women failed the 38-question test8. The survey also found that women want help from an advisor on such things as:

- Retirement income planning

- Healthcare

- Long-term care

- Social security benefits

- Annuities

- Investment risk

Women who have access to a financial advisor are more likely to achieve their retirement goals.

7. Offer Automatic Contribution Escalation Features

Automatic escalation automatically increases an employee’s contribution amount, typically by 1% each year until a total contribution rate is reached. This type of feature can help women easily increase the amount they are saving for retirement. Unfortunately, many plans require employees to choose the option rather than make it automatic.

Be sure to communicate the benefits of this option. Aon Hewitt found that only 15.4% of women enroll in automatic contribution escalation9. A better understanding of how this feature works and how it helps increase retirement savings can encourage women to take advantage of it.

A Team Effort

The more companies work to accommodate the unique situations women face and the more women understand about financial wellness, the smaller the gender gap will be.

See how personalized Financial wellness programs like Enrich can help.

1 - https://www.tiaa.org/public/pdf/2022_financial_wellness_survey_final_results.pdf

2 - https://www.ssa.gov/news/press/factsheets/ss-customer/women-ret.pdf

3 - https://transamericainstitute.org/docs/default-source/research/2021-retirement-outlook-compendium-report.pdf

4 - https://www.cdc.gov/nchs/data/hus/2017/015.pdf

5 - https://www.bls.gov/opub/ted/2022/median-earnings-for-women-in-2021-were-83-1-percent-of-the-median-for-men.htm

6 - https://www.aauw.org/resources/research/deeper-in-debt/

7 - https://resources.betterment.com/hubfs/PDFs/b4b/reports/financial-wellness-benefits-survey.pdf

8 - https://retirement.theamericancollege.edu/2020-retirement-income-literacy-survey

9 - https://ir.aon.com/about-aon/investor-relations/investor-news/news-release-details/2013/Aon-Hewitt-Report-Shows-Women-Lag-Behind-Men-in-Saving-for-Retirement/default.aspx?print=1

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

3 MIN

New Study Provides Answers About Financial Wellness Gender Gap

Employers and Organizations

3 MIN

How Financial Wellness Can Help Employees Understand the Top 3 Social Security Myths

Employers and Organizations

4 MIN

Does Financial Wellness Increase On-time Retirement?