Related Posts

Employers and Organizations

9 Secret Side Effects of Employee Financial Wellness Programs

Last Update: July 26, 2021

More and more companies realize that financially well employees are more productive, miss less work, in better health and happier in their jobs.

To experience financial wellness, your employees need to experience:

- Limited financial stress

- Financial stability

- The ability to retire on time

This comes from having the knowledge, ability, and desire to make intelligent financial decisions to live a happy life within one's means.

Providing employees with customized financial wellness tools and education often leads to other positive side effects like:

Increased Credit Scores

Financial Wellness Behavior Change Data: A 12-Month Study found that credit scores increased an average of 25.51 points for people that used a financial wellness program.

Having a strong credit score is important to your employees when purchasing a home or other big-ticket items. The stronger their credit score, the more loan product options they have available to them.

According to BankRate¹ at the time of this article, no available home loans were available for people with a credit score of less than 620.

Additionally, interest rates are lower for those with better credit scores. For instance, someone with a credit score of 657 would be able to get a 30-year fixed-rate mortgage at 3.48 percent. For a $270,000 loan, your employee would pay $435,387 over the course of the loan. However, if this employee had increased their credit score by 25 points, they could get the same loan at 2.87 percent, saving over $32,000.

Better credit scores also help employees:

- Have access to credit cards with lower rates and better rewards

- Qualify for lower car insurance premiums

- Be approved for housing rentals

- Waive security deposits on utilities

Higher Employee Engagement

A report by Metlife² found that most employees believe their employer has a responsibility to help them achieve financial well-being. The report also found that employees on track with their goals are more engaged than those who are not.

Specifically, these employees are more satisfied with their job, committed to their organization's goals, happy and productive.

Increased employee engagement is one of several factors used in the employee benefit return on investment (ROI) formula.

Increased Retirement Savings

The Enrich Financial Wellness Behavior Change Study found that financial wellness program usage led to 15 percent more employees began participating in the company's 401k plan, and 10 percent more began to participate fully, receiving the company match.

Increasing retirement savings is critical for both employees and employers. According to the Magnify Money 2021 Retirement Statistics Guide³:

- The average US household has just over $255,000 in their retirement accounts, which is not enough money to pay for health-care expenses during retirement

- 49 percent of American households do not have any retirement account

- Nearly one-third of Americans with a retirement account withdrew money from the account due to COVID, and almost half have stopped over lowered their contributions

- 74 percent of employees plan to keep working after retirement age

A Fidelity Investments study4 and one by Prudential5 found that employers experience increased costs and lower productivity when employees delay retirement.

Prudential quantified the cost at $50,000 per employee per year for a one-year retirement delay and even higher costs for delays beyond two years.

Higher Employee Loyalty and Retention

The Metlife study found that financially on-track employees were more likely to be with the company a year later than employees who were not.

Additionally, the PwC 2021 Employee Financial Wellness Survey6 found that nearly three out of four employees with increased financial stress due to the pandemic would be attracted to another company that cared about their financial well-being.

The same PwC survey found that employees use and appreciate financial wellness programs when offered. Of those with access to financial wellness programs, eighty-eight percent participate in the program.

Retaining employees is an important step for organizations since turnover costs are enormous. The Society for Human Resource Management7 (SHRM) suggests that turnover costs equal six to nine months of the replaced employee's salary, with that number being even higher for executives.

Decreased Financial Stress

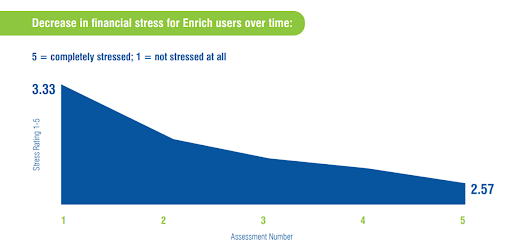

Employees have been looking for ways to reduce financial stress levels, especially since the onset of COVID-19. Data from the Enrich study found that program users' average financial stress level decreased by 23% over 12 months.

PwC's 9th Annual Employee Financial Wellness Survey (2020)8 found that the top cause of stress for employees is financial matters, which was higher than all other stressors combined.

Unfortunately for organizations, half of the employees who suffer from financial anxiety have been distracted by their finances at work compared to just 12 percent of those not suffering from financial stress. That's why reducing employee financial stress is imperative for employers.

Related article: Data Shows Strong Link Between Financial Wellness and Mental Health

Improved Employee Health

The National Institute of Health (NIH)? has found a direct link between financial stress and well-being. In addition to causing depression and anxiety, financial stress can cause, or worsen, the following conditions:

- Heart disease

- Stomach issues

- Eating disorders including weight loss or gain

- Diabetes

- Cancer

- High blood pressure

- Insomnia

- Psoriasis

- Substance abuse

As you help employees decrease their financial stress, you also help them increase their physical wellness.

Related whitepaper: Effects of Financial Literacy on Health

Increased Emergency Savings

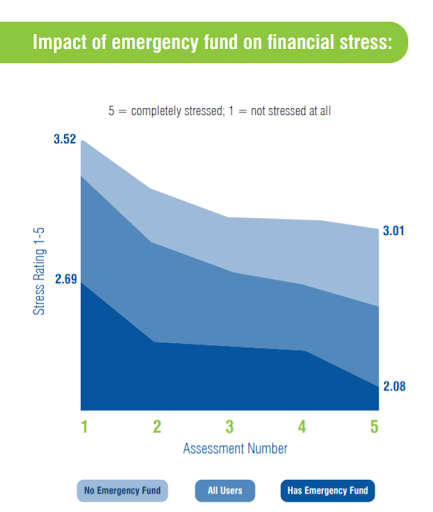

A recent study by Bankrate¹° found that 61 percent of Americans could not pay for a $1,000 emergency expense. However, the Financial Wellness Behavior Change Data shows that of participants using the Enrich Financial Wellness program, 27 percent built up an emergency savings fund.

The study also found that having an emergency fund dropped financial stress by about one point on a five-point scale.

Reducing stress increases engagement and loyalty, so adding a financial wellness program that provides employees with the tools needed to begin saving makes sense.

Improved Debt Management

A Federal Reserve report¹¹ shows that three out of four American households have debt, and the Federal Reserve Bank of New York¹² shows that household debt has reached $14.96 trillion. $4.19 trillion is in non-housing debt such as automobiles, credit cards, and student loans.

However, Enrich found that participants using their financial wellness program managed their debt better. The data shows that:

- 28 percent more pay off their credit card each month

- The average number of checking account overdrafts per month was lower by 40.7 percent

- 32 percent more on track with their financial goals

Increased Awareness of Other Employee Benefits

Forty-three percent of employers¹³ don't believe their workforce knows about or understands all the benefits offered to them.

Companies are investing a large amount of time, energy, and money into these benefit packages, so it makes sense to communicate these benefits to employees effectively.

To get good benefits utilization for your employee benefits package, you must integrate these benefits with on another.

With Enrich, there are over 100 configurations available on the platform which allow employers to integrate and promote underutilized employee benefits.

To see how this financial wellness program is configured, watch this demo video.

1 - https://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

2 - https://www.metlife.com/content/dam/metlifecom/us/sustainability/pdf/Reports-and-statements/reports-and-research/metlife-ebts-financial-wellness-booklet.pdf

3 - https://www.magnifymoney.com/blog/investing/retirement-statistics/

4 - https://institutional.fidelity.com/app/proxy/content?literatureURL=/9889440.PDF

5 - https://www.prudential.com/corporate-insights/employers-should-care-cost-delayed-retirements

6 - https://www.pwc.com/us/en/services/consulting/workforce-of-the-future/library/employee-financial-wellness-survey.html

7 - https://mnwi.usi.com/Resources/Resource-Library/Resource-Library-Article/ArtMID/666/ArticleID/782/Cost-of-employee-turnover

8 - https://www.pwc.com/us/en/services/consulting/workforce-of-the-future/library/financial-well-being-retirement-survey.html

9 - https://www.cnbc.com/2021/01/11/just-39percent-of-americans-could-pay-for-a-1000-emergency-expense.html

10 - https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4738080/

11 - https://www.federalreserve.gov/publications/files/scf20.pdf

12 - https://www.newyorkfed.org/microeconomics/hhdc.html

13 - https://grouprisk.org.uk/2020/10/22/only-57-of-employers-believe-their-workforce-is-aware-of-all-their-benefits-and-understands-them

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

3 MIN

Is Financial Wellness a Must-Have Employee Benefit?

Employers and Organizations

4 MIN

What Are The 3 Keys to Financial Health?

Employers and Organizations

3 MIN

How to Integrate Financial Wellness into an Employee Health and Wellness Program