Related Posts

Financial Institutions

Financial Wellness Programs Can Help Credit Union Members Save $100,000+ on Their Mortgages

Last Update: April 17, 2023

In 2021, 5.4 million Americans joined a credit union as new members, bringing total membership to 131.1 million1. While there are a lot of unique benefits that differentiate credit unions from banks, the main lure for many of these new members is the great mortgage rates – which explains why, between May 2021 and May 2022, total real estate lending also grew 13.7%2.

However, despite offering great rates, many members do not have the credit score needed to take advantage of them. That’s where offering a member financial wellness program comes in.

The Savings Add Up

Imagine being able to help members save $100,000 over the life of their mortgage. That’s a possibility for those who can increase their credit score. Because the score has a direct impact on the interest a member will pay, even small upward changes can benefit your members.

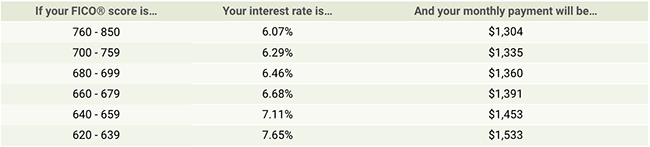

Looking at the latest numbers found on the FICO website3, there is a 1.589% difference in mortgage interest rates between those with the highest credit scores and those with the lowest.

Source: FICO3

Helping Members Understand the Numbers

For many first-time homebuyers, a number like 1.589% doesn’t seem substantial. That’s why it makes sense to help them understand what a small change in an interest rate can do to decrease the amount of money they will eventually pay for their home.

Let’s say you have two members who purchase a home at the current average home price of $348,0004. Both members are able to put 20% down, so their loan amounts will be $278,400. They both choose a 30-year fixed mortgage.

Member 1 has a low credit score of 632. Their interest rate of 6.865% will cost them $379,666 in interest over 30 years.

Member 2 has a credit score of 792. Their interest rate of 5.276% will only cost them $276,904 over 30 years. That is a difference of $102,762.

However, even smaller changes can really add up. If Member 1 can increase their score by just 8 points, they can save $36,399. If they can increase their score by 28 points, they can save $64,242.

How a Financial Wellness Program Helps

The study, Financial Literacy and Economic Outcomes5, found a distinct correlation between strong financial education and higher credit scores. Here are some things a financial wellness program can do to achieve this goal.

Members will learn:

- The factors that determine their score. Understanding these factors helps members determine action steps. For example, since payment history accounts for over one-third of the score, members realize that making timely payments is critical. This can lead them to a goal of making timely payments.

- Why they need to check their credit and how to do it. Many members are unaware that they can check their credit for free once a year. They also do not know that credit reports may have errors and that it is up to the consumer to bring these errors to the attention of their creditors. According to the FTC6, 79% of credit reports have errors. Of those, one in five who get the errors corrected will see their credit score increase by enough to change their credit tier.

- Specific steps to take to increase their credit score. This includes paying bills on time, paying down their credit to lower their credit utilization ratio, obtaining a variety of credit (consumer loans, credit cards, etc), not closing credit cards with a long history, and avoiding taking out new credit too close to purchasing a home.

- Ways to build credit. This includes such things as obtaining a secured credit card, becoming an authorized user on someone else’s card, getting a co-signer on a loan, and putting utility and rent payments in your name.

In addition to building credit, members can learn about the mortgage process, how to save for a down payment, where to find information on homebuyer programs, and more.

Offering a financial wellness program to members is another way to show that you care about their financial health.

1 - https://www.callahan.com/credit-unions-see-record-high-member-engagement-and-relationships-in-4q21/

2 - https://www.cutimes.com/2022/07/11/credit-union-lending-again-sets-records/?slreturn=20220810050903

3 - https://www.myfico.com/loan-center/home-mortgage-rate-comparison/default.aspx

4 - https://www.zillow.com/research/data/

5 - https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5445906/

6 - https://www.ftc.gov/sites/default/files/documents/reports/section-319-fair-and-accurate-credit-transactions-act-2003-fifth-interim-federal-trade-commission/130211factareport.pdf

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Financial Institutions

3 MIN

Think Like a Marketer: Make Sure Your Credit Union Members Get the Benefits Memo

Financial Institutions

3 MIN

5 Easy Ways Credit Unions Can Increase Member Loyalty

Employers and Organizations

3 MIN

Did You Know That Fixing Your Employees' Credit Scores Can Improve Your Bottom Line?