Related Posts

Financial Institutions

How Credit Unions Can Use Financial Literacy to Strengthen Communities

Last Update: January 11, 2024

Experts say that financial literacy can affect every single monetary decision a person makes.1 This ranges from the amount of money people save to how much debt they have and what loan terms they agree to. That's why community financial literacy can have such a large impact.

By introducing initiatives focused on improving financial literacy, a community's financial health can improve. Financial stress becomes less prevalent and economic growth is more feasible.

The link between financial literacy and mental health is also important to note.2

Where Credit Unions Come In

These financial institutions can have a big impact on local communities. Credit unions already provide members with their financial needs – like their first-ever loans for homes, cars, and education.

But they also operate with a member-first mission. This means that they base decisions on what's beneficial for their members. Credit unions can offer lower fees, better interest rates, and more benefits than traditional banks.

Creating Hope for the Future Through Financial Literacy

With appropriate tools and guidance, credit unions can transform their member's financial futures. While most financial institutions offer basic knowledge about financial decisions, credit unions can set themselves apart by tailoring financial literacy programs to meet their members' specific needs.

They can start by:

- Understanding the unique needs of their members

- Developing an education program

- Promoting more informed decision-making

- Giving personalized, interactive, and hands-on lessons that educate members about financial basics

Each of these solutions makes learning about finances less daunting and more empowering. Note that there are even more ways institutions can offer sound financial guidance. See Enrich’s Financial Wellness Program Best Practices Guide to learn more.

Financial Literacy Resources

Promoting financial literacy goes beyond building a content library. As mentioned above, developing an education program is vital. To best promote financial literacy, you need to invest in various teaching tools.

Here’s a look at some of these effective resources that credit unions can leverage:

Customized Financial Education

With customized financial education programs, credit unions can assist their members with making important financial decisions.

Thankfully, offering customized programs is not as complicated as it sounds.

Enrich offers custom-tailored, co-branded or white-labeled financial wellness programs that credit unions can use to engage and empower members. These programs also take into account several significant factors like:

- The business size

- Member demographics

- Individual member’s level of financial knowledge

- Credit scores and financial statuses

Understanding Stress Levels and Behavior Due to Finances

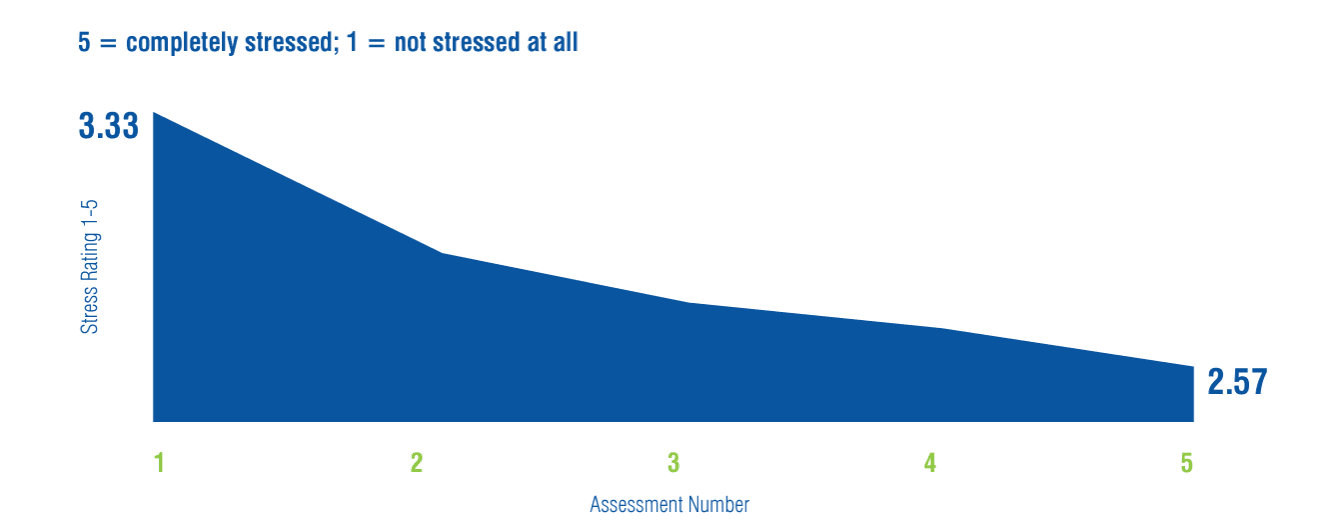

One Enrich study already shows a link between financial literacy and behavior change. Over a year of implementation, members experienced a significant decrease in stress levels.

Source: Enrich

By assessing and understanding member stress levels, credit unions can work to help change members' actual spending behavior and financial priorities. Here's a look at some data from the same study that serve as proof:

- Credit scores rising by 25.51 points

- Checking account overdrafts lowering by 40.7%

- A 55% increase in average savings account balance

- An average of $1,657 savings balance

With members having better financial stability, this also positively affects the overall financial attitude of the entire community.

Reporting Capabilities of Financial Education Platforms

When implementing financial education programs, transparency is also key. By having easy access to reporting tools, credit unions can garner a better understanding of their members' learning progress.

These can include things like member engagement data and regular surveys that evaluate the effectiveness of their literacy education programs.

These insights help make sure the programs are helping lead members in the right direction.

Resources for Employees & Members

Credit unions can provide financial literacy programs for both members and employees. This strategic approach equips everyone with essential financial knowledge, fostering financial literacy within the organization.

With members and employees learning essential financial skills, the entire credit union (and by extension, the community) can improve.

Want to learn more? See a demo video of how Enrich can drive financial literacy within your organization.

FAQs

Why is financial literacy important in credit unions?

Financial literacy empowers credit union members to make informed monetary decisions. Meanwhile, an education resource center can offer financial management tools and techniques. Through these resources, members learn and gain control over their financial future.

How do credit unions help people reach their financial goals?

Credit unions now use several initiatives to help members reach their financial goals. Some of these include:

- The establishment of a financial wellness education program

- No-cost sessions for financial counseling

- Budget calculators

- Site-based messaging about making smarter financial decisions

Why would you choose a credit union rather than a bank for financial services?

Choosing a credit union over a bank has several advantages. Credit unions put their members' interests first. They use profits to provide lower fees and better interest rates. Banks, however, are profit-driven. Their goal is to make money for shareholders. This difference makes credit unions a preferred choice for personalized financial services.

Why is having financial literacy important?

Financial literacy equips people with vital skills to make informed decisions. The understanding of money management lets people access the following benefits:

- An enhanced evaluation of skills for better financial choices

- The ability to identify good or bad financial advice

- Navigating economic challenges with ease and confidence

- Development of saving and investing habits, leading to financial security

- Reduced risk of falling into debt by understanding loan terms

- Letting individuals understand and handle their economic situations

- The creation of an effective financial plan

- Financially responsible and self-reliant communities

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Financial Institutions

ROI for Financial Wellness: Demonstrating Value for Credit Union Members

Financial Institutions

5 MIN

Financial Wellness Programs Can Help Credit Union Members Save $100,000+ on Their Mortgages

Financial Institutions

3 MIN

5 Easy Ways Credit Unions Can Increase Member Loyalty