Related Posts

Employers and Organizations

New Study Shows Alarming Post-COVID Financial Wellness Trends

Last Update: October 18, 2021

Without a doubt, COVID-19 wreaked havoc in 2020 with employees' financial health across the United States.

Unfortunately, a newly released survey by Salary Finance1 has found that employees are no better off in 2021.

Despite the widespread availability of the COVID vaccine, the new CDC guidelines allowing more businesses to reopen, and an increase in job creations, Americans are suffering financially more now than one year ago.

1. Escalating Mortgage Forbearance and Loan Payment Holidays

Many mortgage servicers provided consumers with a mortgage forbearance option during COVID. This allowed consumers to stop making payments for a period of time to help reduce their financial burden.

The CARES Act also allowed consumers with federally backed loans such as an FHA or VA loan to use forbearance.

So, just how many Americans used forbearance? According to the survey, one out of four homeowners used forbearance in the past 12 months.

As with mortgage servicers, many lenders and credit card companies offered a payment holiday to consumers. Like the mortgage forbearance, consumers do not have to make regular monthly payments during the holiday but are expected to make up the missed payments. During this holiday, interest will continue to accrue.

Of consumers eligible to take a loan payment holiday, 33 percent did so.

2. Increased Borrowing

Despite the ability to stall large repayment bills, 65 percent of Americans found that they could not meet their monthly obligations and had to borrow money in the past 12 months.

This is a 5 percent year-over-year increase.

Employees borrowed from:

- Credit cards (51 percent compared to 43 percent in 2020)

- Savings (39 percent compared to 10 percent in 2020)

- Family (30 percent - remained the same year-over-year)

3. Lack of Emergency Savings

Before COVID, just over half of Americans (53 percent)2 did not have an emergency savings account.

Salary Finance found that number had increased to 67 percent, which is not surprising since so many consumers borrowed money from savings to pay bills.

Additionally, the number of Americans who don't consistently save money doubled from 14 percent to 28 percent.

Related article: What Are The 3 Keys to Financial Health?

4. Reduced Retirement Savings

Curing the pandemic, the CARES Act waived many of the traditional early withdrawal fees and tax withholding rules for 401(k)s. This led to a surge in retirement fund loans and early withdrawals.

Additionally, many individuals struggling to make ends meet decreased their retirement contributions in order to pay more time-sensitive bills.

Unfortunately, these behaviors led to decreased retirement savings balances and a loss of interest and dividends which can lead to delayed retirement for employees.

- 36 percent of employees withdrew funds early

- 20 percent of employees withdrew over $10,000

- 20 percent of employees reduced their retirement contributions

- 30 percent of millennials reduced their retirement contributions

5. More Financial Stress

When asked about financial stress, 62 percent of respondents said they are more stressed now than one year ago.

Additionally, almost half (45 percent) report feeling stressed about financial matters within the past week. This number increases for women, Hispanics, LGBTQ+, and those with disabilities. Financial stress has also increased among those making less than $85,000/year.

The survey found that financially stressed employees are:

- 2.3 times more likely to be actively looking for new employment

- 4 times more likely to have poor coworker relationships

- 4 times more likely to produce lower quality work

- 5 times more likely to leave tasks unfinished

- Half as likely to recommend their employer to someone looking for employment

Related article: How Financial Wellness Programs Reduce Employee Financial Stress

Copers Versus Planners

Finally, the survey breaks down employees into five levels of financial fitness:

- Strugglers: These employees have no savings and do not have money to spend beyond basic necessities.

- Copers: Employees in this category have some discretionary money but often find themselves running out of money before the end of the month.

- Builders: Builders have some savings but usually not the needed savings to handle unexpected expenses.

- Planners: This group has an emergency savings account with at least three months' worth of expenses PLUS has a plan in place to meet financial goals.

- Prosperers: Prosperers can live the life they want without worrying about their money situation.

Most employees, unfortunately, fall into the first three categories, leaving them at risk during a crisis, such as the recent pandemic.

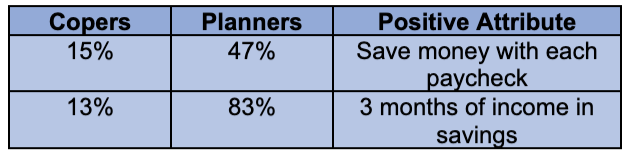

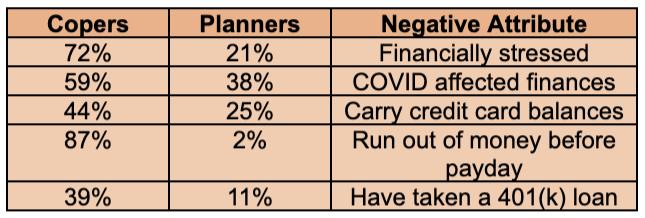

The survey specifically shows how copers compare to planners in both positive and negative financial attributes:

Adding Financial Wellness Benefits

Based on these numbers, it becomes apparent that employers should be working to help employees move from coping to planning by encouraging them to save and budget.

When asked, the benefits most important to employees are those that help them save money, pay down and/or avoid debt, and manage their money. In fact, financial wellness programs have become one of the most desired benefit programs this year.

Fortunately for employers, this is just what financial wellness programs can do for employees.

Recent data from one Enrich user shows that after just one year, more employees saved money, had a fully-funded emergency savings fund, contributed to their retirement plan, and paid off their credit cards each month.

By providing a financial wellness program, employers can decrease employee financial stress and increase employee loyalty and productivity.

It is a win-win proposition.

1 - https://www.salaryfinance.com/us/2021-report/

2 - https://www.aarp.org/content/dam/aarp/ppi/2019/10/unlocking-potential-emergency-savings-accounts.doi.10.26419-2Fppi.00084.001.pdf

Featured Posts

Employers and Organizations

3 MIN

10 Simple Ways Benefits Managers Can Recession-Proof Their Employee Benefits Package

Employers and Organizations

3 MIN

3 Reasons to Make After-Tax Contributions to Your Retirement Plan

Employers and Organizations

4 MIN

Financial Information vs Employee Behavior Change: Which Is More Important for Your Company’s Financial Wellness Program?

Employers and Organizations

3 MIN

Does Your Employee Financial Wellness Program Take Mindset Into Consideration?

Related Posts

Employers and Organizations

3 MIN

Financial Wellness Becomes One of the Most Desired Benefit Programs for 2021

Employers and Organizations

5 MIN

Does Your Financial Wellness Program Teach the Right Spending and Savings Priorities to Your Employees?

Employers and Organizations

4 MIN

COVID Infected Financial Wellness But 3 Simple Steps Will Help